How Many Americans Are Putting Money In Savings

Report: Average American'southward Savings Account Balance is $4,500

Image source: Getty Images

The Federal Reserve reports that 36% of Americans don't take enough money on manus to cover a $400 emergency.

Every adult should have plenty money in savings to cover a minimum of iii months of essential living expenses. Ideally, every developed should have six months' worth. That ways some people nevertheless have work to practise.

But what is the boilerplate savings account balance? How much do Americans save? Practise they favor physical banks or online ones for their savings accounts?

We surveyed 2,000 Americans to observe out.

Key findings

- 78% of Americans have a savings business relationship

- About Americans (22%) have $ane,000 to $5,000 in savings

- 51% of Americans have $5,000 or less in savings, while 35% have $1,000 or less

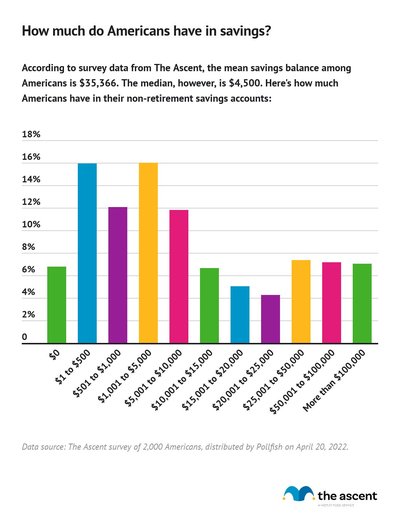

- The median savings amount is $4,500, while the hateful is $35,366

- The median emergency fund is $2,000, while the mean is $xix,342

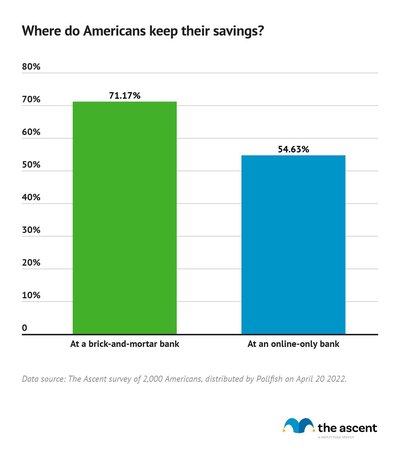

- 71% of Americans keep at least some of their savings at a brick-and-mortar bank

- 53% of Americans with a savings business relationship have more ane

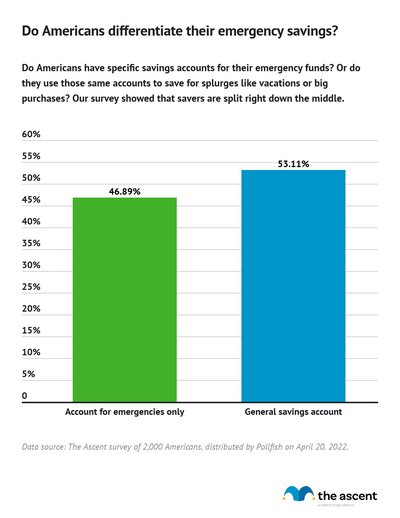

- 47% respondents said they have an account specifically for emergencies

- 70% of respondents automate their savings deposits

A note on averages, medians, and means

You'll note that we cite both the median and the mean for several statistics in this piece, though nosotros rely more heavily on the median as a representation of what'south average. Here's why:

Ways are what nigh people think of equally an boilerplate -- in this case, it would be the total amount of savings in the United states of america divided by the number of people who take savings accounts.

But there'due south a problem with that: very loftier values skew the mean quite a bit. For example, if we have five people who have $10, $100, $i,000, $x,000, and $100,000 in savings, the mean is over $22,000. Is that a expert representation of the average person's savings? Non really.

The median, on the other manus, is the middlemost value. So, in the example above, the median would be $1,000. That'southward a better representation of what most people in the list have in savings. And the median becomes even more robust equally you survey more people.

Nosotros exercise report both the median and the mean, though, so you can compare the ii.

Seventy-one percent of Americans have a savings account. But how much do they have in their accounts?

We asked our respondents how much they had in savings, and the median value was $iv,500. The mean savings residual, nonetheless, is $35,366.

Why such a big gap?

It'due south the small number of people with over $100,000 in the banking company who bring that mean then far up.

However, when a median is much lower than a mean, it ways a larger number of people have less than the mean. To put it but, $iv,500 is more representative of the average savings business relationship remainder.

Most Americans accept $1,000 to $5,000 in savings

In addition to asking virtually the specific corporeality that they had in their savings accounts, we likewise asked people to choose which range their savings barbarous in:

The almost common answer was $1,000 to $5,000, lending further credence to our median finding of $iv,500.

Unfortunately, 51% of Americans have $v,000 or less in savings. And 35% have $i,000 or less. When the boilerplate American'south monthly expenses are $5,111, that'due south not plenty to cover an emergency.

Unfortunately, the numbers are even more dire when we look at savings accounts specifically held for emergencies.

We asked Americans most their emergency funds as well as their general savings accounts. Not anybody keeps a separate business relationship specifically for emergencies, though – we'll talk a flake more than nigh that in a moment.

Among people who do keep a separate account, the median emergency fund remainder is $2,000. The mean emergency fund balance amongst those same people is $nineteen,342.

(We'll talk more than about those people in a moment.)

That mean might seem like a lot, but remember, three months' worth of living expenses is the minimum to aim for with an emergency fund.

Many people need 6 or more months' worth of living costs in the bank to experience secure, so it'due south likely that some people pad their emergency savings for extra peace of listen. An emergency fund calculator tin aid determine how much y'all might need to salvage.

Now it's worth noting that as of mid-2021, 51% of Americans had less than iii months' worth of living expenses in their emergency funds, according to a Bankrate survey. That includes 25% who said they had no emergency savings at all.

71% of people choose physical banks for their savings

Lxx-one percentage of Americans keep their savings account at a brick-and-mortar depository financial institution, compared to 55% of those who keep their savings at an online-merely bank. Those numbers include people who have accounts at both.

What's the meliorate selection -- online versus brick-and-mortar? Well, it depends.

Online banks oft have better interest rates considering their overhead is low -- they don't maintain physical storefronts. Only physical banks might provide better customer service. They likewise offering benefits like safe eolith boxes.

And your estimator screen tin can't spit out greenbacks like an ATM at a brick-and-mortar bank can. Unfortunately, near of the best online savings accounts don't offer ATM cards.

You'll notice that people were able to choose more one option. That'due south because many people with a savings account have more than than 1. And they aren't always at the same bank.

47% of savers differentiate between full general and emergency savings

Some people have a unmarried savings business relationship for general savings and emergencies. Others maintain separate accounts.

In our survey, respondents were carve up roughly every bit between the 2 camps.

There's no right or wrong arroyo.

You should have enough money in the bank to cover a minimum of three months of living costs. If yous have extra cash and it's easier for y'all to manage a single depository financial institution business relationship, consolidating your general savings and emergency fund makes sense.

However, it tin likewise pay to separate those accounts so y'all don't accidentally withdraw from your emergency stash.

Imagine that you need a $ix,000 emergency fund for three months of living expenses. Allow's also say you're saving to take a trip, so you lot keep padding your savings afterward your emergency fund is consummate.

If your balance comes to $10,200, simply your trip costs $1,400, you might accidentally dip into your emergency fund without realizing it.

In that location'south a benefit to keeping those accounts separate.

lxx% of Americans automate their savings

The hard part about saving money is avoiding the temptation to spend. That'southward why it often pays to set up an automatic recurring transfer from a checking account to a savings business relationship.

In our survey, 70% of respondents with a savings business relationship have an automated transfer from checking to savings or an automatic deposit to savings from their paychecks.

This increases the likelihood of meeting savings goals.

Boosted savings statistics

I thing to proceed in mind is that the above numbers stand for average savings account balances based on our survey.

We recognize that our sample set up offers a limited snapshot of how people are saving, so we've compiled some additional data:

- Americans have a cumulative $11.7463 trillion in savings, according to the Federal Reserve. When we separate that number by 209,128,094 U.S. adults and assume that 71% have a savings account as per our findings above, nosotros get an average savings account remainder of $39,710.

- A Transamerica Centre for Retirement Studies plant that Americans take a median emergency savings rest of $five,000.

- In March of 2022, the personal savings rate was 6.ii% -- meaning Americans were saving that percentage of their income -- but this doesn't distinguish between full general savings and other types of savings, like retirement.

- According to the Fed, twoscore% of households accept at least three months of living expenses saved; 28% have at to the lowest degree six months of living expenses saved.

- In 2021, Americans had an average personal savings balance of $73,100, according to Northwestern Mutual's Planning & Progress Study. Only 21% had $four,999 in savings or less.

Almost half of American families have no retirement savings

So far we've focused on well-nigh-term savings -- money to tap in a pinch. Merely what almost long-term retirement savings?

Simply 54% of families headed by workers anile 32 to 61 participate in whatsoever kind of retirement programme, which means nearly one-half of families have no retirement savings at all, co-ordinate to the Economic Policy Institute. Meanwhile, the estimated median retirement savings across all generations is $93,000, co-ordinate to Transamerica. This is somewhat consistent with Nationwide, which has boilerplate retirement savings at $98,800.

Older workers unremarkably take larger retirement plan savings balances than younger workers, since they've had more time to relieve and invest.

Practise your savings need a boost?

The median general savings and emergency savings balances among our respondents indicate that most households have less saved than what they should.

Given that the average American household spends $5,111 every month, a median rest of $2,000 isn't going to cut it for emergency savings. Of class, when we take the boilerplate balance of $19,342 in emergency savings, those numbers get a lot more comforting.

But almost people have account balances well below these averages.

If you feel that your savings could employ some work, a few unproblematic moves on your part could help your bank business relationship grow:

- Stick to a budget. It will help yous see where your money goes each month and identify ways to cut corners and bank the difference -- a budgeting app can assist with this

- Automate the process. Arranging for an automatic transfer means you won't have to call back most moving money yourself and you'll remove the temptation to spend.

- Get a side gig to boost your savings rate. Information technology will take pressure off your regular paycheck and help you avoid having to drastically cutting dorsum on spending.

We all need savings to pay for emergencies and run across our personal goals. One time your bank account balance starts looking more robust, y'all'll sleep ameliorate at nighttime knowing that if the demand for money arises, yous've got it covered.

Methodology

The Ascent distributed this survey via Pollfish to 2,000 American adults ages 18 and over on April 20, 2022. While efforts were made to create a representative sample, in that location is variability in any sampling method, and no strict statistical testing was performed.

Respondents were 59% female and 41% male. Age breakdown was approximately 13% xviii–24, 28% 25–34, 27% 35–44, 15% 45–54, and 17% over 54.

Some percentages may not full to 100% due to rounding.

Source: https://www.fool.com/the-ascent/research/average-savings-account-balance/#:~:text=The%20most%20common%20answer%20was,enough%20to%20cover%20an%20emergency.

Posted by: lagoinswer1963.blogspot.com

0 Response to "How Many Americans Are Putting Money In Savings"

Post a Comment